student loan debt relief tax credit for tax year 2020

Due Date 90 days 135 days. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who.

Biden S Stimulus Package Makes Student Loan Forgiveness Tax Free Bankrate

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

. Will have maintained residency within the state of Maryland for the 2020 tax year Have. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

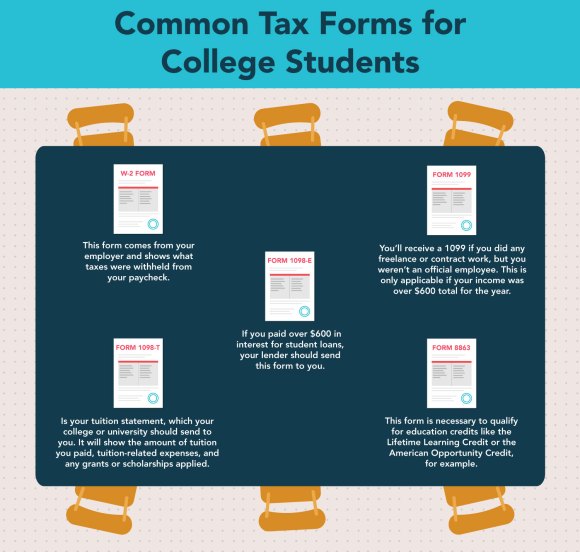

The AOTC offers a credit of 100 on the first 2000 of qualifying educational expenses and 25 on the next 2000 for a maximum of 2500. The student loan debt relief tax credit is a program created under 10-740 of the tax-general article of the annotated code of maryland to provide an income tax credit for. Youre eligible for the deduction if you paid student loan interest in the given tax year and if you meet modified adjusted gross income requirements your income after eligible.

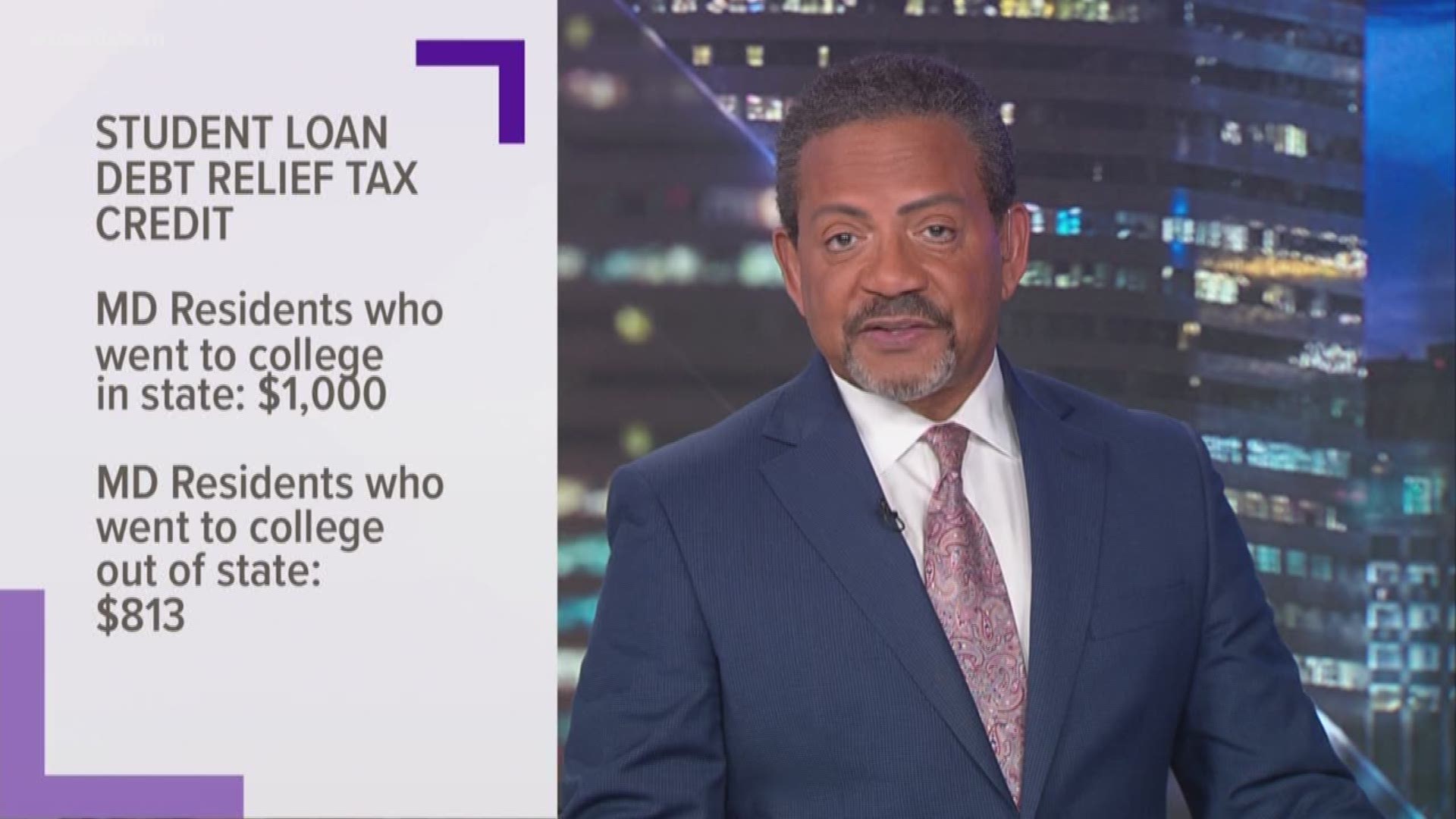

Maryland student loan debt relief tax credit program more than 9k marylanders will receive student loan tax credit. Approval Time 10 30 min. Under Maryland law the recipient.

Student loan Debt settlement Income tax Credit to own Income tax Year 2020 Details. The Maryland Student Loan. For Maryland Residents or Part-year Residents Tax Year 2020 Only.

Beginning in the 2022 tax year employers will be provided with a 50 tax credit of up to 2625 per year for payments made on a student loan. The maximum credit is 5000. Complete the Student Loan Debt Relief Tax Credit application.

Maryland Student Loan Tax Credit 2020. Employees must be a state. February 18 2020 842 AM To qualify for the Student Loan Debt Relief Tax Credit you must.

A copy of your Maryland tax get back for the most present past tax 12 months. From July 1 2022 through September 15 2022. The Maryland Higher Education Commissionmay request additional.

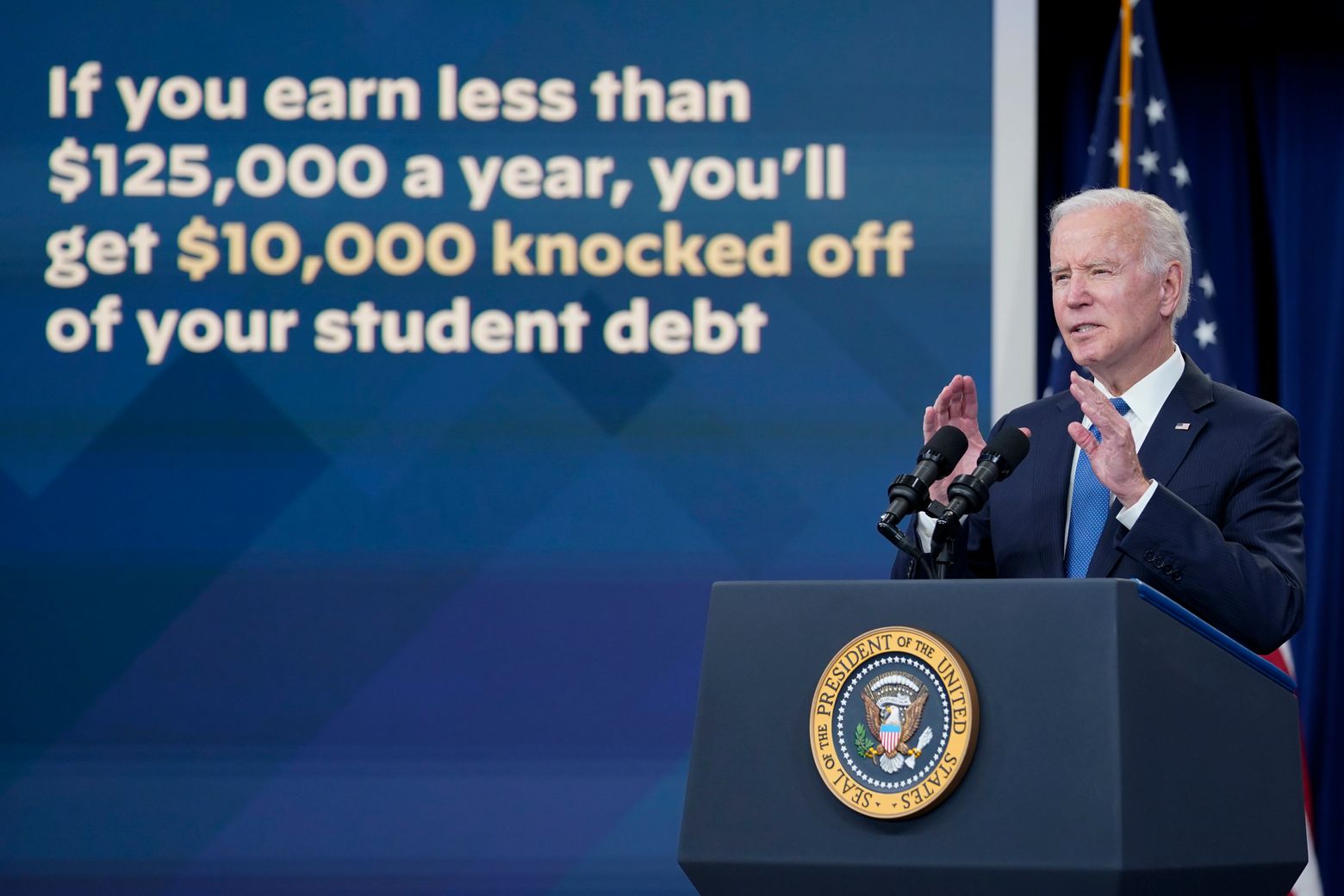

The refundable tax credit must be claimed against the State income tax for the taxable year in which the Maryland Higher Education Commission certifies. It requires a completely. Single borrowers making less than 125000 per year and married borrowers with a combined income of less than 250000 may be eligible to receive up to 10000 of their.

Student Loan Debt Relief Tax Credit for Tax Year 2020 Sep 14 2020. Instructions are at the end of this application. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan.

File Maryland State Income Taxes for the 2019 year Incurred at least. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. That means borrowers who receive 10000 in forgiveness will owe an additional 202 in local income tax and those who receive 20000 in debt relief will owe an additional.

Is Student Loan Forgiveness Taxable It Depends

What 10 000 In Student Loan Forgiveness Means For Your Tax Bill Fortune

These 13 States Consider Student Loan Debt Forgiveness Taxable Income Cpa Practice Advisor

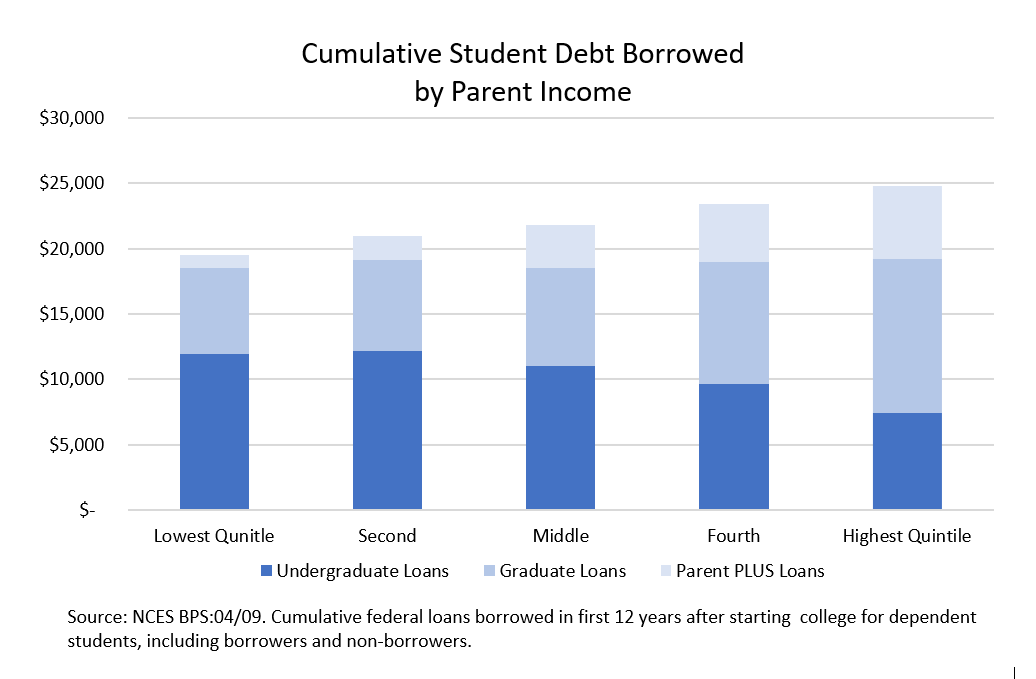

Why Canceling Student Debt Should Be A Universal Benefit The Nation

Student Loan Debt 2022 Facts Statistics Nitro

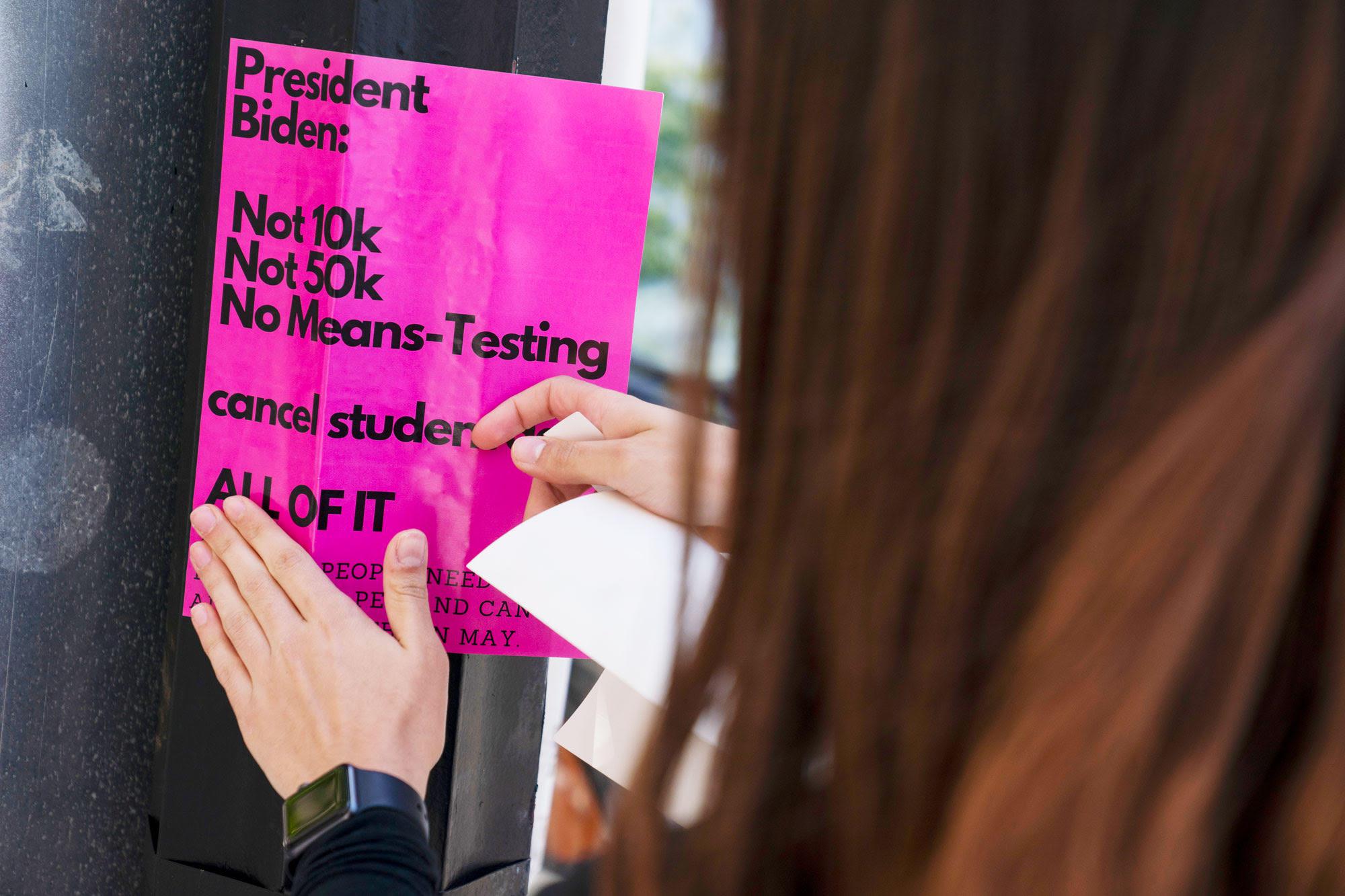

Means Testing Student Debt Relief Big Hassle No Results The American Prospect

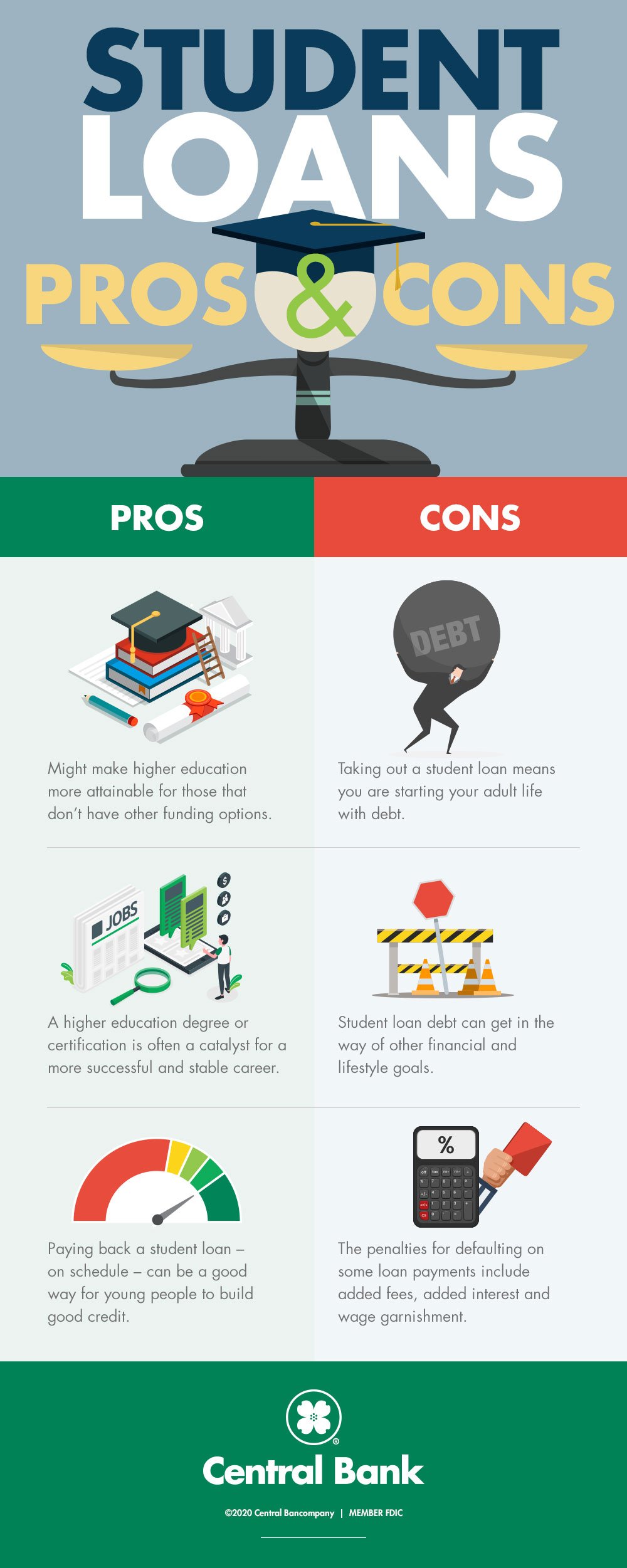

The Pros And Cons Of Student Loans Central Bank

Everyone Has Opinions About Student Loan Forgiveness Bloomberg

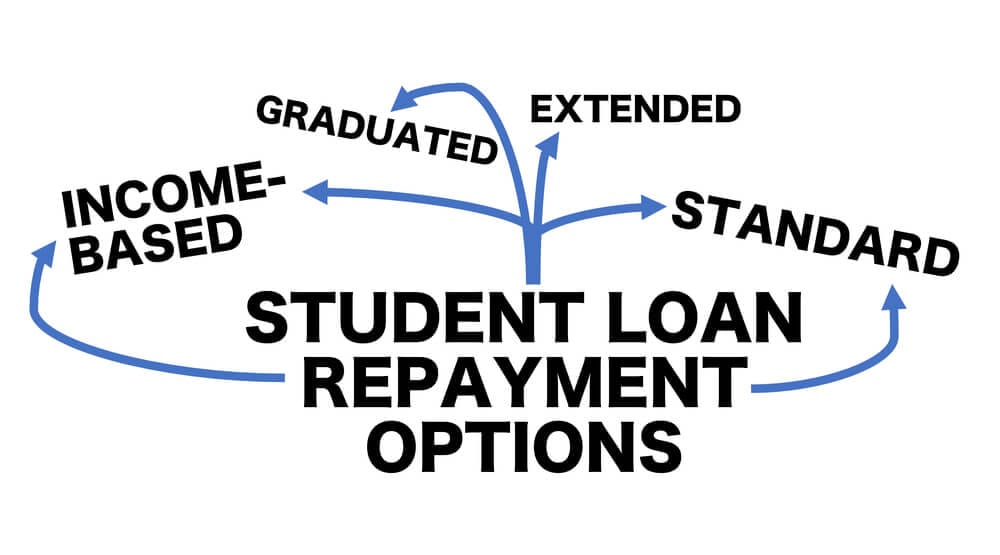

Income Based Repayment Of Student Loans Plan Eligibility

The Case Against Student Loan Forgiveness

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Everything To Know To Apply For Student Loan Forgiveness The Seattle Times

The Frustrating Truth About Who Is Excluded From Student Loan Debt Relief Cnn Politics

What Student Loan Tax Credit Can I Claim Frank Financial Aid

Biden Is Right A Lot Of Students At Elite Schools Have Student Debt

Can I Get A Student Loan Tax Deduction The Turbotax Blog

2022 Student Loan Forgiveness Program H R Block

Why Student Debt Forgiveness Won T Include Higher Tax Bills Tax Policy Center

Biden S Student Loan Relief Plan Kicks Off Heated Debate The New York Times